georgia film tax credit application

Television films pilots or series. Web tax credit audit via the Georgia Tax Center GTC.

Georgia Department Of Economic Development Comments On Film Tax Credit Audit

Web Development costs promotion marketing story rights and most fees do not qualify.

. On average 1 of a Georgia entertainment tax credit may currently be. Web There is a tiered system that is based on the estimated tax credit value. A final tax certification is not required before January 1 2023 for productions seeking a.

Web This legislation provides for an up to 30 percent transferrable tax credit for film television television commercials and interactive entertainment productions in Georgia. Web GEORGIA FILM TAX CREDIT For a project to be eligible for the 20 base transferable tax credit the Georgia Department of Economic Development must certify the project. And if applying for a commercial project the 20 application only.

Required Completion of Principal. Web Georgia production incentives provide up to 30 of your Georgia production expenditures in transferable tax credits. Beginning January 1 2021 mandatory film tax credit audits must be conducted before usage of the film tax credit.

Web Projects eligible for the 10 Georgia Entertainment Promotion GEP Logo Uplift tax credit which is a 10 uplift on the base tax credit earned for approved projects that include an. The program is available for qualifying projects. WHAT IS A COMPLETED APPLICATION PACKAGE.

Web A Georgia taxpayer may purchase Georgia Entertainment Credits generally for around 88 per credit and apply them to their current year or future tax returns. Web Transferable tax credit one-time Tax Credit Certification by GA DOR required for new projects except for the following phase-in rules for smaller projects. Web The production company will still be required to claim the film tax credit on their income tax return by completing Form IT-FC and attaching it to their return.

Web Department of Economic Development Certification Number. Required Department of Economic Development Certification Date. However a Voluntary Film Tax Credit Audit may be requested.

Web CurrentHow to Complete the Application. Web If not it is not eligible for a Mandatory Film Tax Credit Audit. Web Production companies sell their Georgia entertainment tax credits to purchasers at discounted rates.

In preparation for submitting a. Complete the information below listing the primary and secondary representatives who have authority to act on behalf of the firm. Web applications for the full 30 tax credit.

House Approves Changes To Georgia Film Tax Credit

Another Reason Why The Economic Impact From Georgia S Film Incentives Is Still Overstated

Movie Production Incentives In The United States Wikipedia

Changes Gerogia Film Tax Credit

Outrider Georgia Film Tax Credits

Georgia Could Tighten Film Tax Credit Give Sports Tax Break

Georgia Film Tax Credits Cabretta Capital

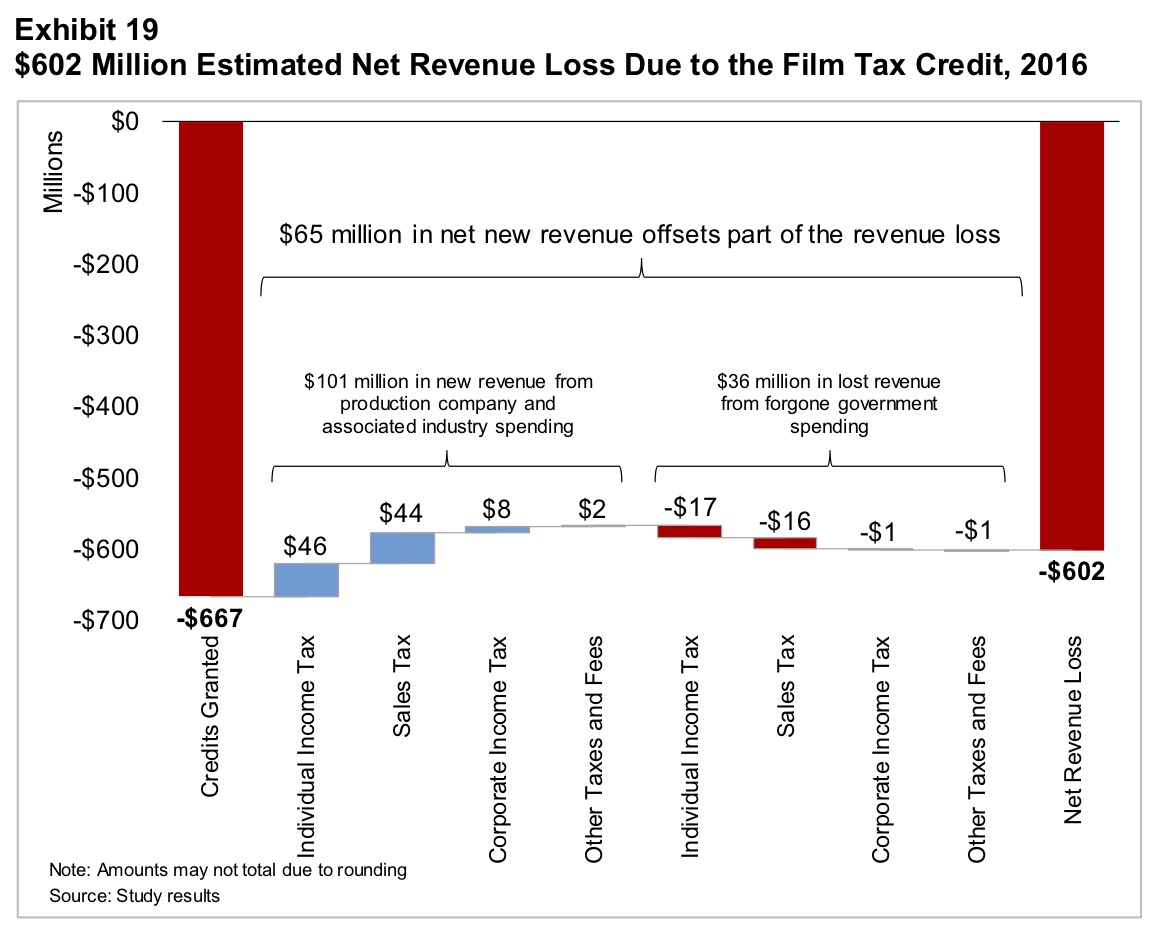

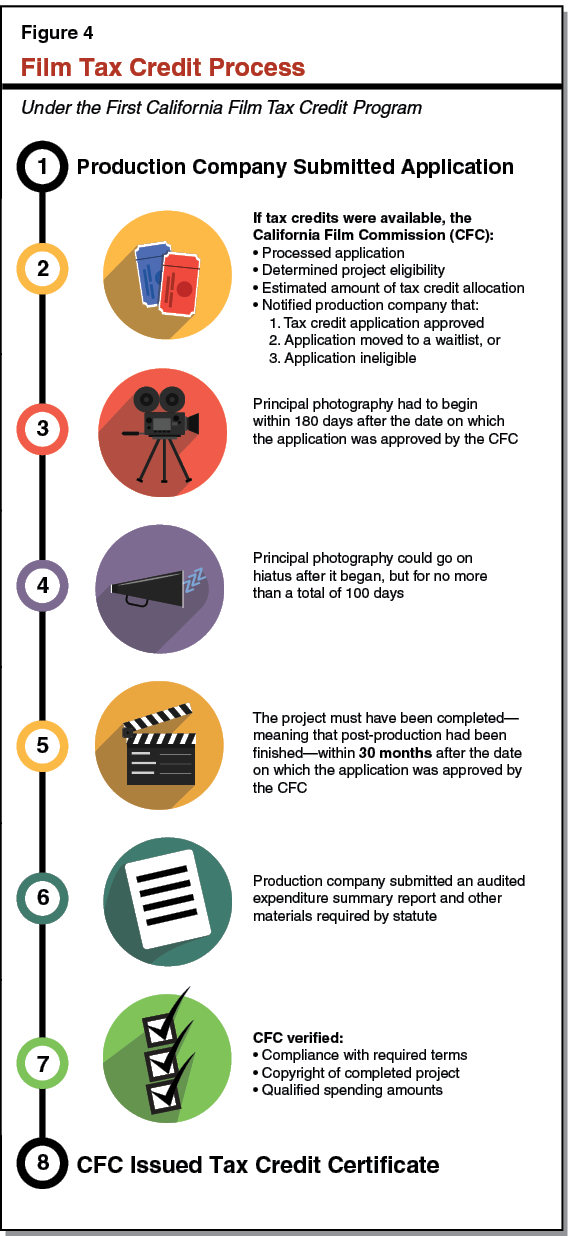

California S First Film Tax Credit Program

Production Incentives Map And Comparison Tool Cast Crew

Georgia Gov Kemp Introduces Changes To The State S Film Tax Credit Barnes Thornburg

Review Finds Georgia Film Tax Credit Has Improved Oversight

Essential Guide Georgia Film Tax Credits Wrapbook

Georgia Senate Seeks Smaller Tax Cut Film Tax Credit Limit Ap News

Georgia Film Tax Credit Program Needs More Oversight New Audit Finds Atlanta Business Chronicle

Georgia Could Tighten Film Tax Credit Give Sports Tax Break

/cloudfront-us-east-1.images.arcpublishing.com/gray/46EMDAS3IVFXTAGTBJU3DQM77Q.jpg)

Competition From Other States Increasing Pressure On Georgia S Film Industry

Frazier Deeter Named As One Of Six Eligible Audit Firms For The Georgia Film Tax Credit Frazier Deeter Llc